Excitement About Estate Planning Attorney

Table of ContentsNot known Details About Estate Planning Attorney 8 Easy Facts About Estate Planning Attorney DescribedHow Estate Planning Attorney can Save You Time, Stress, and Money.The 30-Second Trick For Estate Planning Attorney

Your attorney will also help you make your files official, organizing for witnesses and notary public signatures as needed, so you don't need to bother with trying to do that last step on your very own - Estate Planning Attorney. Last, however not the very least, there is valuable assurance in developing a relationship with an estate planning lawyer that can be there for you later onPut simply, estate preparation attorneys offer value in several methods, far past simply providing you with published wills, trust funds, or other estate planning records. If you have concerns about the procedure and wish to find out a lot more, contact our workplace today.

An estate planning lawyer helps you define end-of-life decisions and lawful files. They can establish up wills, establish trust funds, produce healthcare regulations, develop power of lawyer, produce succession strategies, and more, according to your desires. Working with an estate preparation lawyer to complete and manage this legal documents can help you in the complying with eight areas: Estate intending attorneys are specialists in your state's count on, probate, and tax obligation laws.

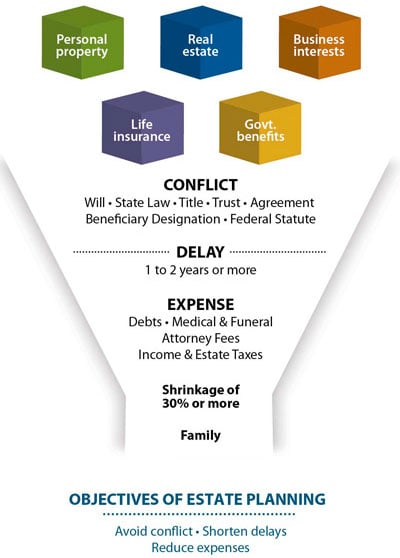

If you do not have a will, the state can choose just how to divide your possessions amongst your heirs, which could not be according to your wishes. An estate preparation attorney can assist arrange all your legal records and distribute your possessions as you wish, possibly avoiding probate. Many individuals compose estate preparation files and afterwards ignore them.

Unknown Facts About Estate Planning Attorney

Once a client passes away, an estate plan would certainly determine the dispersal of properties per the deceased's instructions. Estate Planning Attorney. Without an estate plan, these decisions may be delegated the following of kin or the state. Obligations of estate planners consist of: Developing a last will and testimony Establishing depend on accounts Naming an executor and power of attorneys Identifying all recipients Calling a guardian for small youngsters Paying all debts and lessening all taxes and legal charges Crafting directions for passing your values Establishing preferences for funeral arrangements Completing directions for care if you end up being ill and are unable to choose Getting life insurance policy, handicap revenue insurance coverage, and lasting treatment insurance coverage A great estate strategy must be updated frequently as navigate to this site clients' economic situations, individual motivations, and government and state regulations all progress

Similar to any kind of occupation, there are characteristics and abilities that can help you attain these goals as you deal with your clients in an estate planner function. An estate planning career can be appropriate for you if you possess the adhering to characteristics: Being an estate organizer implies assuming in the long term.

Not known Details About Estate Planning Attorney

You must assist your customer anticipate his or her end of life and what will take place postmortem, while at the exact same time not home on morbid ideas or feelings. Some customers may become bitter or anxious when considering death and it might fall to you to aid them with it.

In case of fatality, you might be see it here anticipated to have various discussions and ventures with enduring member of the family concerning the estate strategy. In order to stand out as an estate planner, you might need to walk a great line of being a shoulder to lean on and the private relied on to communicate estate preparation matters in a prompt and specialist way.

tax obligation code altered thousands of times in the one decade in between 2001 and 2012. Expect that it has actually been changed additionally because after that. Relying on your client's monetary revenue bracket, which might evolve toward end-of-life, you as an estate planner will certainly have to maintain your client's properties in complete legal conformity with any type of local, federal, or worldwide tax obligation regulations.

Estate Planning Attorney Fundamentals Explained

Acquiring this qualification from companies like the National Institute of Licensed Estate Planners, Inc. can be a strong differentiator. Being a member of these specialist teams can verify your skills, making you extra eye-catching in the eyes of a prospective client. In addition to the emotional reward helpful customers with end-of-life planning, estate planners enjoy the advantages of a steady income.

Estate preparation is an intelligent thing to do no matter of your present health and economic condition. Not so many individuals understand where to start the procedure. The initial important thing is to employ an estate planning lawyer to help you with it. The complying with are five advantages of collaborating with an estate preparation attorney.

A skilled attorney understands what information to include in the will, including your recipients and special considerations. It additionally provides the swiftest and most reliable approach to transfer your assets to your beneficiaries.